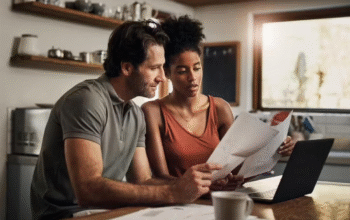

Navigating the unpredictable waters of the financial markets can be both exhilarating and daunting. For traders in the UK, market volatility is a familiar yet challenging landscape, where rapid price swings offer both risks and rewards. Amid this ever-changing environment, Contracts for Difference (CFDs) have emerged as a potent tool, enabling traders to not only endure but thrive during turbulent times. This exploration will uncover how CFD trading can transform market volatility from a threat into a powerful catalyst for growth, offering new strategies and perspectives for the modern investor.

CFD trading hinges on the ability to speculate on price movements without the necessity of owning the actual asset. This unique characteristic provides a level of flexibility that traditional trading methods cannot match. For those looking to trade share CFDs, it means engaging with the price movements of major UK and international stocks without the financial commitment and complexities of full ownership. This agility is particularly valuable in volatile markets, where quick, strategic adjustments can make all the difference.

One of the most compelling strategies within CFD trading is the capacity to profit from both rising and falling markets. Unlike traditional investments that typically benefit only from upward trends, CFDs allow traders to go long or short, adapting to market conditions with precision. In volatile periods, when prices can swing significantly, this dual capability becomes a critical advantage. It empowers traders to harness market movements in either direction, turning volatility into a dynamic playground for profit.

The use of leverage in CFD trading further amplifies the potential gains from small price fluctuations. Leverage allows traders to control larger positions with a relatively modest capital outlay, magnifying both potential profits and risks. This means that even minor market movements can result in substantial returns. However, the same mechanism that enhances profits also increases the potential for losses, making effective risk management indispensable. Savvy traders employ strategies such as stop-loss orders to safeguard their capital, ensuring that their risk exposure is carefully controlled.

Diversification is another pivotal aspect of CFD trading that can help mitigate the impact of market volatility. CFDs provide access to a wide array of markets, including shares, indices, forex, and commodities, all from a single platform. This broad market access allows traders to diversify their portfolios, spreading their risk across various asset classes. For those trading share CFDs, this means the opportunity to balance their exposure with other investments, creating a more robust and resilient portfolio. Diversification not only reduces the risk associated with any single market but also enhances the potential for returns across multiple fronts.

Staying informed and continuously educating oneself is crucial in the world of CFD trading. The financial markets are influenced by a myriad of factors, including economic indicators, political events, and corporate developments. A deep understanding of these influences and their potential impacts on market prices can equip traders with the insights necessary to make informed decisions. Keeping abreast of market trends, news, and analysis allows traders to anticipate volatility and position their portfolios advantageously.

In essence, market volatility, while often seen as a challenge, offers abundant opportunities for those equipped with the right tools and strategies. CFD trading provides UK investors with a versatile and effective means to navigate these turbulent waters. By leveraging the flexibility to trade share CFDs in both rising and falling markets, employing robust risk management practices, diversifying across multiple asset classes, and committing to continuous learning, traders can turn market volatility into a significant advantage.

Moreover, CFD trading platforms are increasingly sophisticated, offering advanced tools and resources that support traders in their decision-making processes. These platforms provide real-time data, analytical tools, and automated trading options that enable traders to execute their strategies with greater precision and efficiency. This technological support is crucial for maintaining an edge in fast-moving markets, where timely and informed decisions can make a substantial difference in outcomes.