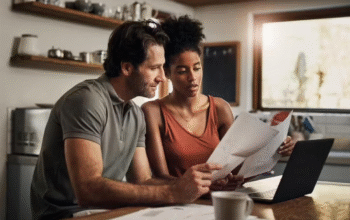

Credit cards are handy to use anytime and anywhere for various transactions. Want to pay bills? Use your credit card instead of standing in queues to save time and ensure safety during the pandemic. Shopping or travelling? Carry your card instead of hard-to-manage bundles of cash.

When it comes to a credit card, you can apply online instantly to again not risk going out in this pandemic. But before that, you need to choose a good card. So, here are 4 tips to pick the right credit card for yourself.

4 Tips to Get Yourself the Right Credit Card

- Look for low-interest credit cards

Interest is charged on the outstanding amount of your credit card balance. It’s also charged when you’re late to pay credit dues.

So, apply for a credit card with the lowest interest rate to:

- Minimise any finance (interest) charges when an outstanding balance is unavoidable.

- Help pay off credit dues faster.

- Help maintain a good credit score.

- Check for special features

A good credit card offers various useful features to maximise your benefits of using it.

So, apply for a credit card that, for example, offers the following features to save you from certain charges:

- A lifetime free credit card can ward off annual maintenance fees forever. Such fees are otherwise charged to keep your card account open and let you use its benefits.

- Zero over-the-limit fees credit card won’t charge you when you make card-based transactions exceeding the assigned credit limit.

- With interest-free cash withdrawals, you can avoid cash advance fees when you use your credit card to draw cash.

- There may be no charges on requesting a duplicate credit card statement.

- See for unlimited rewards

You can apply for a credit card that offers reward points every time you make a card-related transaction. These rewards range from discounts at partner merchants to gift vouchers.

Check if the credit card offers the following additional benefits on rewards:

- You can get up to 10X credit points.

- No redemption fees are charged on using rewards.

- The credit points aren’t capped. So they’re limitlessly available!

- The reward points don’t expire. So you’ll never lose them! But check them regularly to avail of the limited period offers under the rewards.

- More rewards on online credit card transactions than those offline. So, while earning more rewards, you can safely fight the pandemic from home.

- Check for associations with partner merchants

Ensure to apply for a credit card tied to multiple partner merchants.

Such a card offers time-to-time discounts, for example, on health services including hospital charges and purchase of online medicines. This can be particularly helpful for a medical emergency during this pandemic.

Other offers can keep popping up on:

- Shopping and lifestyle like branded garment purchases

- Services like legal and more

- Education and upskilling like annual educational subscriptions

- Travels like hotel bookings

- Dining like five-star restaurant services

Carefully read all the terms and conditions of your credit card to make the best use of it.